On July 1, 2024, several new federal regulations went into effect in a bid by Department of Education officials to “oversee predatory and low-quality institutions of post-secondary education”.

Perhaps the most prominent change is that federal regulations no longer permit colleges that receive federal financial aid to withhold transcripts for course credits paid for with federal money. As it would be extremely difficult for institutions to determine which credits in a student’s transcript were paid for with federal funds, and subsequently to solely release transcripts with those courses, it is likely that this change to the federal regulation will amount to a national ban on the practice of withholding student transcripts when there is a balance owed by the student.

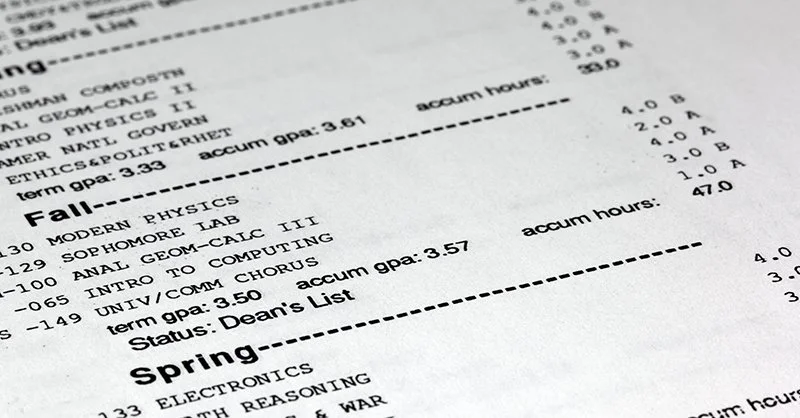

Students throughout the United States have struggled to get their higher education institution to release their transcript because they owe a balance to the institution. This phenomenon creates stranded credits, or academic credits that a student has earned but which cannot be verified due to the institution’s refusal to release the transcript. If a student cannot get their transcript, they cannot prove the credits they have earned to any other institution and have to start over if they wish to continue their education elsewhere. According to the 2024 Transcript Regulation Impact Survey (TRIS) by the American Association of Collegiate Registrars and Admissions Officers, there are 6.5 million people in the United States with stranded credits with roughly $15 billion in debt owed to higher education institutions.

This practice of withholding transcripts is utilized by higher education institutions to force students to pay the debts owed on their balance in order to have access to the formal record of their academic progress. This practice disproportionately impacts low-income students and students of color, and further bolsters inequities in the education system. Encouraging institutions to stop engaging in this predatory practice is one thing the Department of Education can do to help students that are struggling under the burden of student debt.

Students aren’t out of the woods yet, though: several of the new regulations are already facing legal challenges, and whether this particular regulation remains in place will likely depend on how federal courts interpret the recent Supreme Court ruling in Loper Bright Enterprises v. Raimondo, which curtailed Chevron[1] deference and substantially limited the regulatory power of federal agencies.

If you are a student struggling to get your higher education institution to release your transcript due to a balance owed, we recommend you consult with an attorney to see if you can use these new regulations to your advantage and get your transcript released to you.

Written by education attorney, Megan Mitchell at Abdnour Weiker, LLP

www.Lawyers4Students.com

[1] In Chevron v. Natural Resources Defense Council, the Supreme Court held that when a legislative delegation to an administrative/regulatory agency was not explicit but was implicit, the court could not substitute their own interpretation of the statute for a reasonable interpretation by the agency. This case created what is known as Chevron deference, wherein courts deferred to federal agencies on their reasonable interpretations of the regulatory statutes. In the recent decision in Loper, the Supreme Court has effectively put an end to the practice of Chevron deference.